The Quadruple Model of Cash Flows «About + Download Link»

The Cash Flow Quadrant Model book gives you the recipe for financial freedom, and strikes against outdated beliefs to show you that you are wrong when you think that job is security! The writer talks about his own experience and does not stand in the place of theorizing. But what is this model?

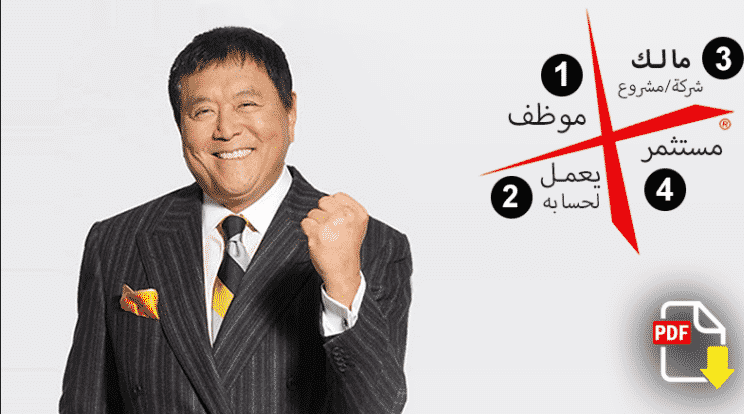

It simply consists of four squares..as in the drawing below..the left section is defended by the poor father being job security..while the right section is defended by the rich father being financial freedom.

The cash flow quadrant model:

Let’s start with the letter E, which means the employee..whether he works in a government or private sector..the main idea is that the employee exchanges his time and effort for money, so if he stops working, his income will be cut off..so this is a risk, not a job security!

The second letter S is for a self-employed person, such as an engineer, doctor, lawyer, or self-employed person.. This person has more audacity to open his own business and does not receive a fixed salary at the end of the month, but also if he stops working, his income will be cut off, and herein lies the risk.

As for the right section, the financial freedom section consists of the letter B, which means the field of projects (Business), that is, you are the owner of a project in which you have a work system. .

The fourth and final section consists of the letter I, which means the investor. Here, money brings money, so there is no need to implement a system, and there is no need to work, only profitable and feasible investments to achieve financial freedom for you.

The book says that the path to financial freedom, that is, moving from the left side to the right side, requires not only a change in the tools used, but also a change in personality and way of thinking, and this is something that not everyone can do in any case.

Robert sheds light on many misconceptions in our lives. People define wealth as a lot of abundant money..but this is not true..wealth is the number of days in which you can pay your expenses without the need for work..many people get a lot of money daily, but they have obligations Also big, so he’s not rich.

In order to be in the category of the investor of the quadruple model, you must focus on investments that generate income on an ongoing basis, meaning that the money works on your behalf and generates your current income for you, so if someone bought a house and rented it as a kind of investment, then if the rent obtained increases its value On the operating expenses of the property, the source of income then becomes the investor field of the form.

And because financial crises afflict the world from every side, job security has become false, and today people are in dire need to move to invest. Financial intelligence is not how much money you make, but how much money you save, how well the money works for you, and how many generations you will keep it.

Among the misconceptions that the writer corrects us is that assets “are everything that generates money in your pocket,” and “liabilities are everything that takes money out of your pocket,” so buying a house for residence is not considered an asset, but rather a liability.

You may be interested: I will not be a slave to salary pdf book

He spoke fairly about taxes and their effect on moving between the boxes of the form and this applies mainly to America where investors have tax privileges to defer, mitigate or even evade it by legal means while employees always pay the tax because it is withheld at source.

Cash Flow Quadrant Model: Download Link